This in-depth guide offers young families practical strategies for saving, investing, and making wise financial decisions in the dynamic 2024 economy. It highlights the role of a paystub generator in managing variable incomes and fostering better financial planning and stability.

Introduction:

As we step into 2024, the financial landscape continues to evolve, presenting young families with both challenges and opportunities. Understanding and adapting to these changes is crucial for long-term financial well-being.

This article is tailored to assist young families in navigating these complexities with innovative saving tips, investment strategies, and smart money management techniques.

Particularly for those with variable incomes or self-employment, tools like a paystub generator become invaluable in tracking earnings and planning finances effectively.

Understanding Your Financial Standing

Overview

The journey to financial stability begins with a comprehensive understanding of your current financial situation. For young families in 2024, this means evaluating income sources, expenses, debts, and savings. Knowing where you stand financially enables you to set realistic goals and create effective strategies to achieve them.

Key Steps in Assessing Financial Health:

1. Income Analysis: Document all income sources, including salaries, freelance income, and any passive income streams. For those with variable income, such as self-employed individuals, a paystub generator can be particularly useful. It not only tracks income but also provides paystub templates for documentation that can be critical for loan applications or rental agreements.

2. High-Interest Savings Accounts: Invest in savings accounts with higher interest rates, like a share certificate, to maximize the return on your savings.

3. Expense Tracking: Keep a record of monthly expenses, categorizing them into essentials (like rent, utilities, groceries) and non-essentials (such as dining out, entertainment). This helps in identifying areas where spending can be reduced.

4. Debt Assessment: List all debts, including credit card balances, student loans, and mortgages. Understanding your debt situation is crucial for effective debt management and prioritization.

5. Savings and Emergency Funds: Evaluate your savings, focusing on emergency funds. Ideally, this should cover 3-6 months of living expenses, providing a cushion for unforeseen circumstances.

Using a Paystub Generator:

For families with irregular incomes, a paystub generator is a vital tool. Brands like ThePayStubs, PayStubs.net and PaystubCreator offer user-friendly services to cater to diverse needs. It helps in:

– Consistent Income Documentation: Regularly generating paystubs creates a consistent financial record, aiding in financial planning and discussions with financial advisors.

– Budgeting: By understanding income patterns, families can create more accurate budgets that accommodate fluctuating income levels.

– Tax Preparation: Paystubs simplify tax calculations, ensuring families don’t overpay or underpay taxes.

A clear understanding of your financial standing is the cornerstone of sound financial planning. It’s the first step towards making informed decisions that align with your family’s goals and needs. In the next section, we’ll explore smart saving strategies that young families can adopt in 2024.

Smart Saving Strategies for 2024

Overview

Saving money is a crucial aspect of financial planning, especially for young families looking to secure their future. In 2024, there are numerous innovative ways to save, leveraging technology and modern financial tools.

Effective Saving Techniques:

1. Automated Savings Plans: Utilize banking apps or financial tools that automatically transfer a portion of your income to a savings account. This “set and forget” method ensures consistent savings.

2. High-Interest Savings Accounts: Invest in savings accounts with higher interest rates to maximize the return on your savings.

3. Reducing Expenses: Identify non-essential expenses where you can cut back. Small changes, like dining in more often or opting for less expensive entertainment options, can add up over time.

Leveraging Paystub Generator Data for Savings:

A paystub generator can enhance your saving efforts by:

– Identifying Saving Opportunities: Reviewing income patterns can help in recognizing periods where you can save more.

– Budget Adjustments: For fluctuating incomes, paystub data can guide adjustments in your savings strategy during higher-income periods.

Adopting these smart saving strategies can significantly improve a young family’s financial resilience. In the next section, we will delve into the world of investments and how to choose options that best suit your family’s needs.

Investing in Your Family’s Future

Overview

Investing is a powerful tool for young families in 2024 to build wealth and secure their financial future. It’s about making your money work for you, but it requires careful planning and understanding of the options available.

Investment Avenues for Young Families:

1. Stocks and Mutual Funds: Investing in the stock market can offer higher returns, though with greater risk. Mutual funds, managed by professionals, can be a more diversified and less risky option.

2. Real Estate: Owning property can be a stable long-term investment, offering both rental income and potential appreciation in value.

3. Education Savings Plans: Setting up education funds for children ensures that their future educational needs are taken care of.

4. Retirement Accounts: Investing in retirement accounts like IRAs or 401(k)s is essential for long-term financial security.

Utilizing Paystub Data for Investment Decisions:

– Assessing Risk Tolerance: Paystub generator data helps in understanding income stability, which is crucial in determining how much risk you can afford to take with your investments.

– Investment Planning: Regular income insights can guide the timing and amount of investments, especially for those with variable incomes.

Investing wisely requires balancing risk and return, especially for young families with varying financial commitments. In the next section, we will focus on making informed financial decisions, a key component of managing your family’s finances effectively.

Section 4: Making Informed Financial Decisions

Overview

The financial world is complex and ever-changing, making informed decision-making crucial for young families in 2024. Staying informed and using the right tools can make a significant difference in financial success.

Strategies for Informed Decision-Making:

1. Stay Economically Informed: Keeping up with financial news and trends helps you understand the broader economic environment and its impact on your finances.

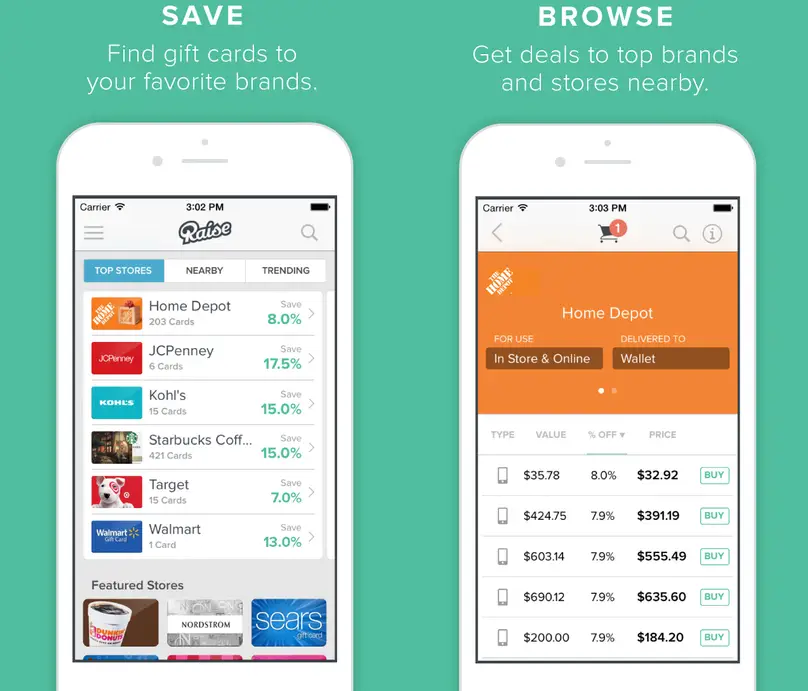

2. Use Financial Planning Tools: Leverage budgeting apps, investment calculators, and other digital tools to plan and track your financial goals.

3. Seek Professional Advice: Don’t hesitate to consult financial advisors, especially for significant decisions like buying a house or investing a large sum of money.

Role of a Paystub Generator:

– Income Tracking for Better Decisions: Regular income tracking with a paystub generator provides a clear picture of your earnings, which is essential for making informed financial choices.

– Planning Major Purchases: Insights into your income flow can guide decisions on when and how to make major purchases or investments.

Making informed financial decisions requires a combination of staying informed, utilizing the right tools, and seeking expert advice. For young families, especially those with variable incomes, a paystub generator is a valuable tool in this process.

Final Conclusion:

For young families in 2024, mastering the art of financial planning involves understanding their financial situation, saving smartly, investing wisely, and making informed decisions.

A paystub generator emerges as a critical tool, especially for those with variable incomes, aiding in every step of this journey. By adopting these strategies, young families can navigate the financial challenges of today’s world and build a stable and prosperous future.