Dive into the dynamic world of cryptocurrencies where the promise of passive income beckons. Whether you’re a seasoned investor or new to the digital currency space, understanding the top five crypto investment strategies can unlock a steady stream of earnings without the daily grind.

Explore how these innovative opportunities can transform your investment approach and potentially pad your wallet. Investors seeking guidance in the dynamic crypto market can connect apps like this platform, an investment education firm that links traders with knowledgeable experts.

Staking Cryptocurrencies

This process is crucial for proof-of-stake (PoS) blockchains, where validators are chosen based on the number of coins they hold and are willing to “stake” as collateral.

By staking your tokens, you help maintain the security and efficiency of the blockchain while earning rewards, typically in the form of additional tokens. The return on investment can vary significantly depending on the blockchain’s staking rules, the amount staked, and the overall network conditions.

Popular cryptocurrencies for staking include Ethereum, Tezos, and Cardano, each offering different staking mechanisms and reward systems.

The attractiveness of staking lies not only in earning potential but also in its relative simplicity compared to other crypto investment strategies. It doesn’t require significant trading skills or constant market monitoring.

However, stakers must be mindful of the risks, such as the volatility of crypto prices and potential security threats to the staking platforms. Despite these risks, staking remains a preferred route for investors looking to contribute to blockchain ecosystems while growing their digital assets.

Yield Farming and Liquidity Mining

Yield farming and liquidity mining are at the forefront of the decentralized finance (DeFi) movement, presenting lucrative, albeit complex, opportunities for earning passive income. Yield farming involves lending or staking cryptocurrencies within a DeFi platform to generate high returns, often in the form of additional cryptocurrency.

Liquidity mining is a related concept where users provide liquidity to a DeFi token pool (e.g., a trading pair on a decentralized exchange) and earn rewards in return.

These practices have gained immense popularity due to their high yield potential, with some platforms offering triple-digit annual percentage yields (APY). Participants can move their assets between different protocols to optimize their returns, a strategy known as “crop rotation” in the yield farming community.

Key platforms in this space include Uniswap, SushiSwap, and Compound, each providing different mechanisms for earning rewards.

However, the high reward potential comes with high risks. The complexity of yield farming strategies, coupled with the volatility and experimental nature of DeFi projects, can expose liquidity miners to significant risks, including smart contract vulnerabilities and impermanent loss.

As such, these strategies are best suited for more experienced users who understand the underlying protocols and can manage the associated risks.

Crypto Lending Platforms

Crypto lending offers a more stable income stream compared to the often speculative nature of other crypto investments. It’s particularly appealing to those who prefer holding their assets over the long term. Lenders can choose from a variety of currencies to lend, including more stable options like USDC and riskier alternatives like Ethereum or Bitcoin.

The operation of these platforms is generally straightforward: users deposit their cryptocurrency into a smart contract, which then disburses loans to borrowers. The loans are often over-collateralized to minimize the risk of default.

Nevertheless, risks exist, particularly related to the security of the lending platform and the volatility of the crypto market, which can still impact the value of the collateral and the interest earned.

Investing in Crypto Dividend Tokens

Crypto dividend tokens represent a relatively new but rapidly growing area in the digital assets space. Holders of these tokens are entitled to receive dividends, typically derived from the profits of a specific project or company. These dividends are distributed as additional tokens directly to the holders’ wallets.

Examples of dividend-paying tokens include COSS, KuCoin Shares, and NEO, each providing different dividend mechanisms and rates. Investing in these tokens can be particularly attractive as it provides a dual opportunity for profit: from the appreciation of the token itself and from the dividends received, which can be reinvested or converted into other assets.

However, investing in dividend tokens requires due diligence. The viability of dividends depends heavily on the success of the underlying project and the legal structure around the dividends. Investors need to assess the transparency and sustainability of the dividend distribution policies and the overall project’s health to ensure steady returns.

Crypto Index Funds and ETFs

The benefits of investing in crypto index funds include lower risk due to diversification, simplicity compared to managing individual investments, and lower fees than actively managed funds. Examples of crypto index funds include the Bitwise 10 Crypto Index Fund, which tracks the top 10 cryptocurrencies by market capitalization.

Crypto ETFs, while similar, are traded on traditional stock exchanges and can be bought and sold like stocks, offering even greater accessibility and liquidity. However, the availability of crypto ETFs is still limited in many regions due to regulatory hurdles. For investors able to access them, crypto ETFs provide a convenient and potentially less volatile way to invest in cryptocurrency.

Each of these investment opportunities offers a unique blend of risk and reward, catering to different investor profiles and objectives in the dynamic crypto market.

Conclusion

Navigating the world of crypto investments for passive income is an exciting journey that combines innovation with opportunity. By leveraging strategies like staking, yield farming, and crypto lending, investors can harness the power of digital currencies to create a robust income stream. Embrace these top investment avenues and watch your financial landscape evolve with the digital age.

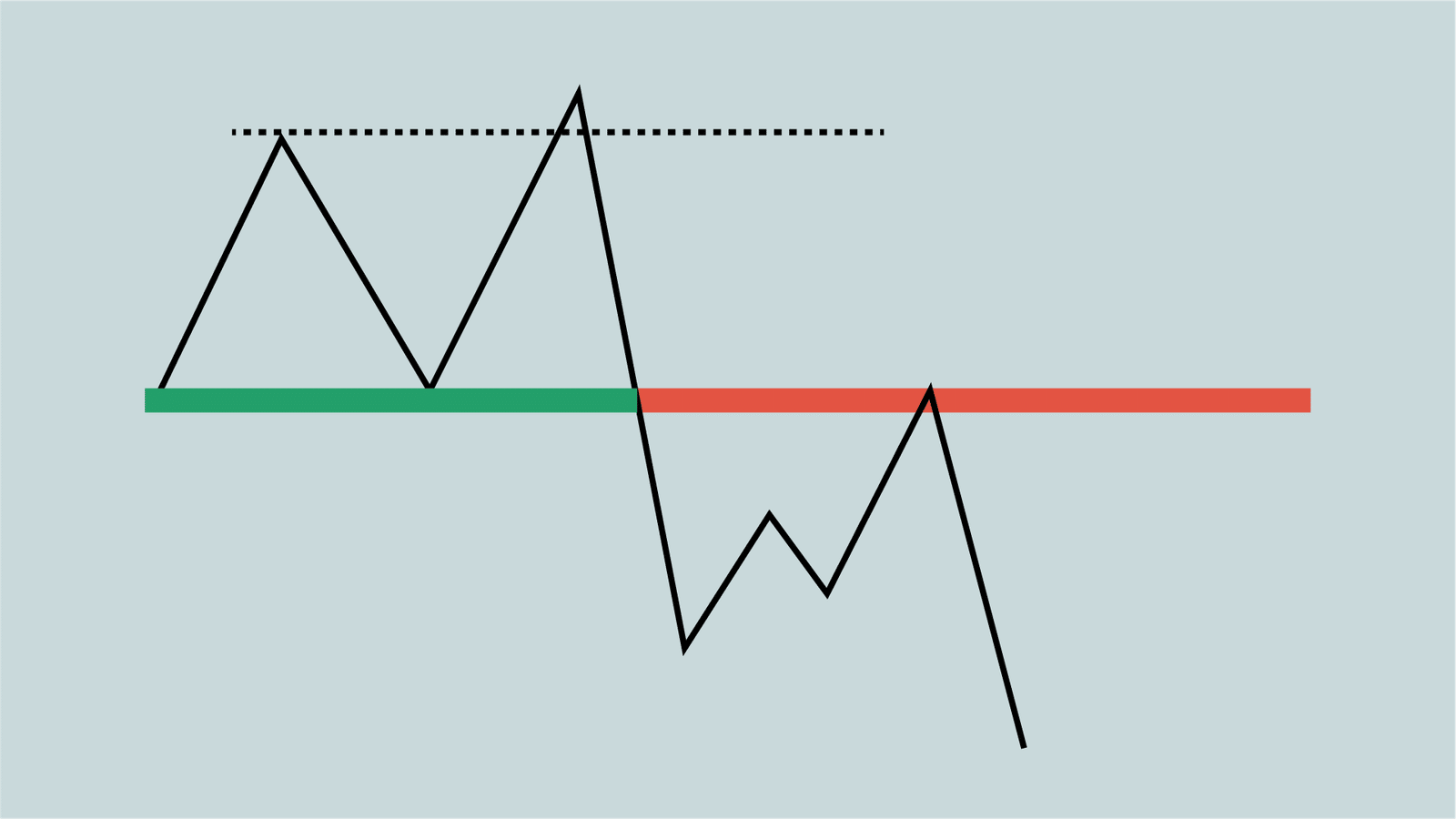

Developing a trading strategy that effectively incorporates technical indicators requires a meticulous approach, blending analytical rigor with practical market insights.

Developing a trading strategy that effectively incorporates technical indicators requires a meticulous approach, blending analytical rigor with practical market insights. Combining technical indicators with fundamental analysis offers a comprehensive approach to stock market investing, potentially leading to more informed and balanced trading decisions.

Combining technical indicators with fundamental analysis offers a comprehensive approach to stock market investing, potentially leading to more informed and balanced trading decisions. Incorporating technical indicators into risk management strategies is a critical practice for traders aiming to minimize losses and protect investments. Technical indicators do not just help in identifying potential entry and exit points but also in setting robust risk parameters like stop-loss orders and position sizing.

Incorporating technical indicators into risk management strategies is a critical practice for traders aiming to minimize losses and protect investments. Technical indicators do not just help in identifying potential entry and exit points but also in setting robust risk parameters like stop-loss orders and position sizing.

According to

According to

Generating pay stubs online is a practical solution for freelancers needing to prove income. These

Generating pay stubs online is a practical solution for freelancers needing to prove income. These  Invoices and contracts outline the agreed-upon terms, payment schedules, and amounts due for each project, serving as vital proof of income for freelancers. To get the most out of them, ensure you have detailed invoices that include client information, project descriptions, hours worked or deliverables provided, and payment terms.

Invoices and contracts outline the agreed-upon terms, payment schedules, and amounts due for each project, serving as vital proof of income for freelancers. To get the most out of them, ensure you have detailed invoices that include client information, project descriptions, hours worked or deliverables provided, and payment terms. Using accounting software can simplify the process of proving income for freelancers. Platforms like QuickBooks, FreshBooks, or Xero provide detailed financial reports that compile data from various sources into clear summaries.

Using accounting software can simplify the process of proving income for freelancers. Platforms like QuickBooks, FreshBooks, or Xero provide detailed financial reports that compile data from various sources into clear summaries.

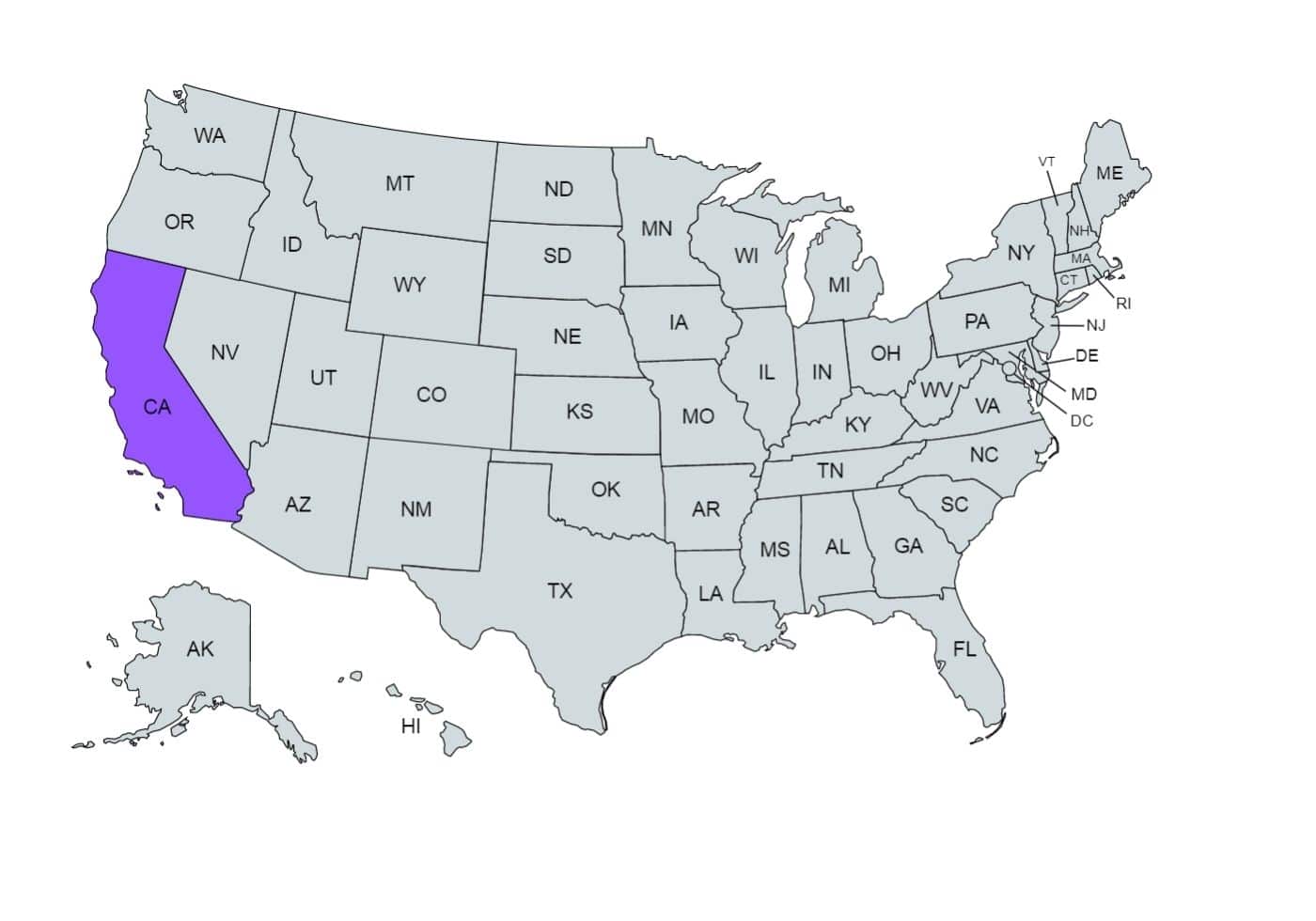

A California paycheck calculator is an online tool designed to help individuals and employers estimate net pay after deductions. It takes into account various factors specific to California, such as state taxes, local taxes, and other mandatory deductions. By inputting details like gross salary, filing status, and additional withholdings, users can get a clear picture of their take-home pay.

A California paycheck calculator is an online tool designed to help individuals and employers estimate net pay after deductions. It takes into account various factors specific to California, such as state taxes, local taxes, and other mandatory deductions. By inputting details like gross salary, filing status, and additional withholdings, users can get a clear picture of their take-home pay. Here are some benefits of using a California paycheck calculator:

Here are some benefits of using a California paycheck calculator: Check these specific considerations for California:

Check these specific considerations for California: Tips and tricks for choosing the right paycheck calculator:

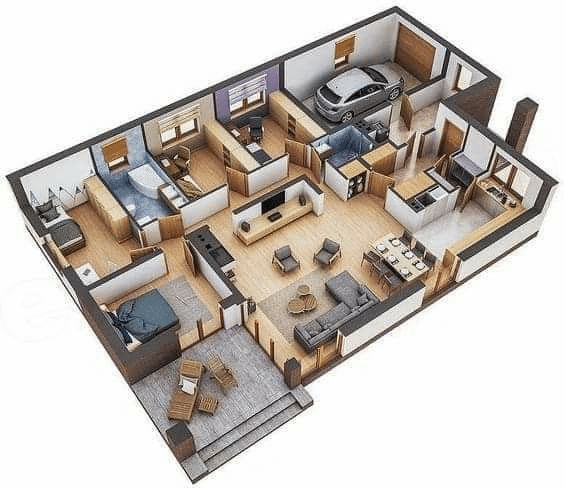

Tips and tricks for choosing the right paycheck calculator: One common misconception is that virtual offices are only suitable for startups or small businesses. While it’s true that many startups utilize virtual offices to save on costs, large enterprises also benefit from virtual office solutions.

One common misconception is that virtual offices are only suitable for startups or small businesses. While it’s true that many startups utilize virtual offices to save on costs, large enterprises also benefit from virtual office solutions. Some people believe that virtual offices lead to decreased productivity due to the lack of a structured work environment.

Some people believe that virtual offices lead to decreased productivity due to the lack of a structured work environment. The idea that virtual offices are impersonal and isolate employees is another common myth. In reality, virtual offices can foster a strong company culture and community.

The idea that virtual offices are impersonal and isolate employees is another common myth. In reality, virtual offices can foster a strong company culture and community.