Are you a new parent trying to figure out all those baby expenses? You’ve probably got a baby monitor on your shopping list—but did you know it might be FSA eligible?

That little device that brings peace of mind when your baby sleeps might actually save you money on taxes. Many parents don’t realize they could use their Flexible Spending Account funds for this essential item.

Between diapers, formula, and all the gear babies need, every dollar counts. Finding out which baby items qualify for FSA coverage can make a real difference in your budget.

Are you wondering if your baby monitor makes the cut?

Before we discuss the FSA details, let’s first understand baby monitors and why they’ve become a must-have for today’s parents.

What’s a Baby Monitor?

A baby monitor is your extra set of eyes and ears when you can’t be in the same room as your little one. Think of it as a window into your baby’s world when you’re doing dishes, taking a shower, or trying to get some sleep yourself.

Why Would You Need One?

Ever wished you could be in two places at once? That’s exactly what a baby monitor does for tired parents! It lets you know when your baby needs you,

For first-time parents, these devices can be a lifesaver during those nerve-wracking early weeks. They help you balance hovering over the crib and getting much-needed personal space.

Now that you know about these handy devices, let’s examine how baby monitors work to keep your little one safe.

How Do Baby Monitors Work?

Baby monitors use technology to help you keep tabs on your child. They connect a device in your baby’s room to a receiver you carry.

The basic setup includes:

- A transmitter unit in your baby’s room

- A parent unit you keep with you

- A range of about 600-1,000 feet in most homes

Newer models connect to your smartphone through Wi-Fi. This lets you check on your baby even when you’re not at home.

These little devices bring peace of mind to parents everywhere. But can you pay for one with your FSA account? Let’s find out next.

FSA Basics: What You Need to Know

An FSA (Flexible Spending Account) helps you save money on health costs. It lets you set aside money from your paycheck before taxes are paid.

What is an FSA? This special account holds money just for health expenses. Since the money isn’t taxed, you get more bang for your buck. Think of it as getting a discount on medical items you’d buy anyway.

How does it work? When you buy something that qualifies, you can use FSA funds to pay for it. This means you’re using pre-tax dollars, which can save you 20-30% compared to using regular money.

Who decides? The IRS creates rules about what items qualify for FSA spending. Your specific FSA provider may have additional guidelines, too. The IRS updates these rules occasionally, so checking before purchasing is smart.

But the big question for new parents is: Which baby monitors actually qualify for FSA coverage? Let’s find out which models you can buy using your pre-tax dollars.

Which Baby Monitors Can You Buy with FSA?

FSA-Eligible Monitors:

| Type of Monitor | Features | Requirements | Additional Information |

|---|---|---|---|

| Medical-grade monitors | Track breathing, heart rate, oxygen levels | Letter of Medical Necessity from pediatrician explaining specific health concern | Often more expensive than standard monitors ($150-$400) |

| Smart sock monitors | Monitor vital signs through the foot sensor | Doctor’s note stating medical reason, such as premature birth or respiratory issues | The battery typically lasts 18-24 hours before recharging |

| Specialized breathing monitors | Alert for apnea or breathing pauses | Prescription or detailed note from the doctor explaining risk factors | May require a monthly subscription for advanced tracking ($5-$15/month) |

| Medical condition monitors | For babies with specific health concerns | Detailed documentation of the baby’s condition and why monitor is necessary | Some insurances may cover part of the cost before FSA is used |

Regular Monitors Don’t Qualify:

Standard audio or video baby monitors don’t make the FSA cut. These everyday monitors help you hear crying or see if your baby is awake, but they don’t have medical tracking features.

The IRS views regular monitors as ordinary parenting tools, not medical devices. This means the basic monitor on your registry likely won’t qualify for those tax-free FSA dollars.

What’s the key difference? FSA-eligible monitors must serve a medical purpose beyond just letting you know when your baby is fussing.

Things to Check Before Buying

Before spending your hard-earned FSA dollars on a baby monitor, here are some important things to consider:

- Medical Need: Think about whether your baby truly needs a medical monitor for health reasons. Is your pediatrician concerned about breathing issues, heart rate, or oxygen levels? Regular parenting worries usually don’t qualify, but genuine medical concerns might.

- FSA Provider Rules: Each FSA administrator has their own set of guidelines. Some providers are more flexible than others about what they’ll approve. It’s worth a quick call to your specific provider before making a purchase.

- Documentation: Most FSA providers will ask for a letter of medical necessity from your doctor. This note should explain your baby’s condition and why this specific monitor is needed for their health—not just for your peace of mind.

- Product Features: Look for monitors specifically marketed as “medical-grade” or “health tracking.” These usually mention vital sign monitoring rather than just audio or video capabilities. The packaging or product description often states if it’s FSA/HSA eligible.

Making sure you check these boxes can save you from the headache of denied claims and help you make the most of your healthcare funds.

How to Use FSA Funds for a Baby Monitor

Ready to put those tax-free dollars to work for your baby’s health? Here’s how to use your FSA funds to purchase an eligible monitor:

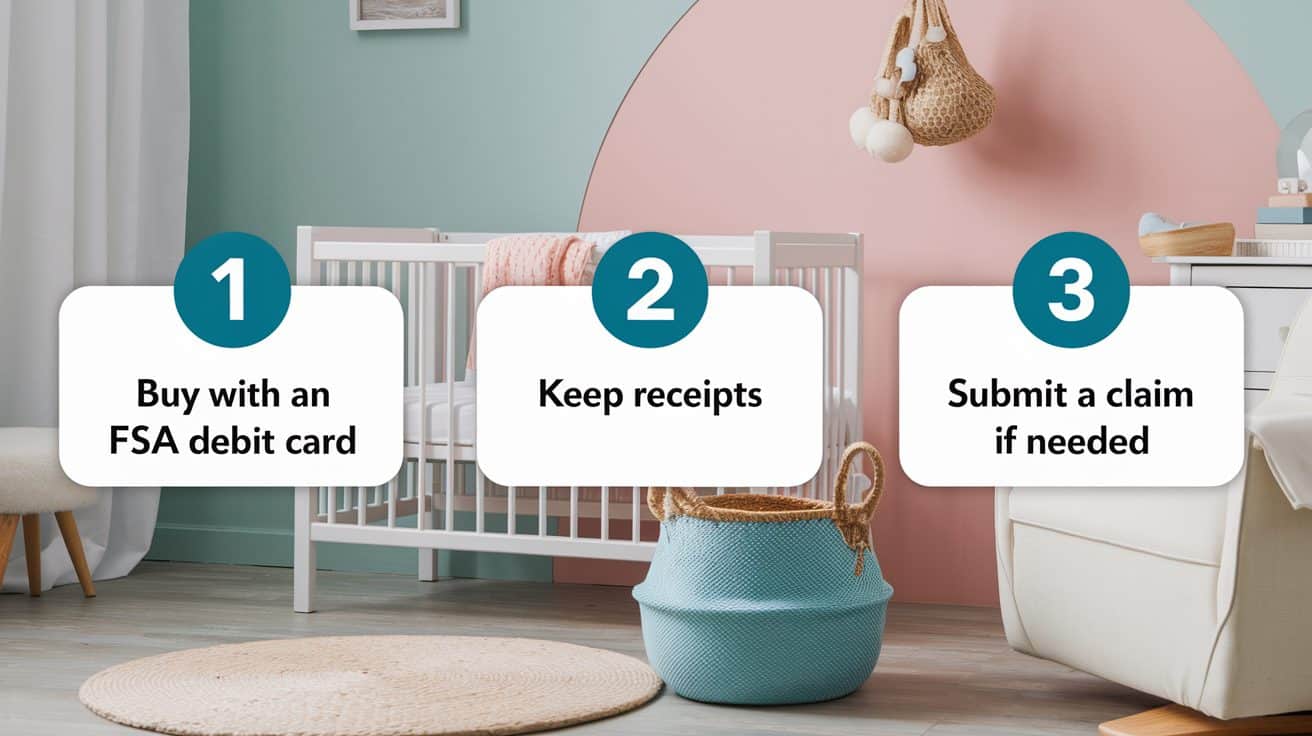

- FSA Debit Card: The simplest way is to pay with your FSA debit card at checkout. Many medical supply stores and online retailers specializing in FSA-eligible items will process these transactions automatically. Just swipe your card like you would a regular credit card.

- Reimbursement: If you prefer another payment method, keep your itemized receipt. You must submit this receipt to your FSA administrator along with a claim form. Most providers offer online portals where you can upload photos of your receipts and get paid back within a few weeks.

- Double-Check Before Buying: Contact your FSA provider directly before spending money. Ask them specifically about the monitor you plan to purchase. This quick phone call can save you from the disappointment of a rejected claim.

Remember that the rules can change, so what qualified last year might not qualify this year. A little preparation can save you frustration later when using your FSA benefits for your baby’s needs.

Making the Most of Your FSA!

Navigating the world of FSA-eligible baby monitors doesn’t have to be complicated. With the right information and some preparation, you can put those pre-tax dollars to work for your family.

Remember that medical necessity is the key factor in whether your baby monitor qualifies. While standard video monitors typically don’t cut, those that track vital health metrics often do—with proper documentation.

Before you shop, call your FSA provider to check if your chosen monitor qualifies. This small step can save you money and stress.

Ready to find the right monitor for your family?

Check out our recommended FSA-eligible baby monitor guide and start shopping with confidence. Your baby’s health—and your wallet—will thank you!