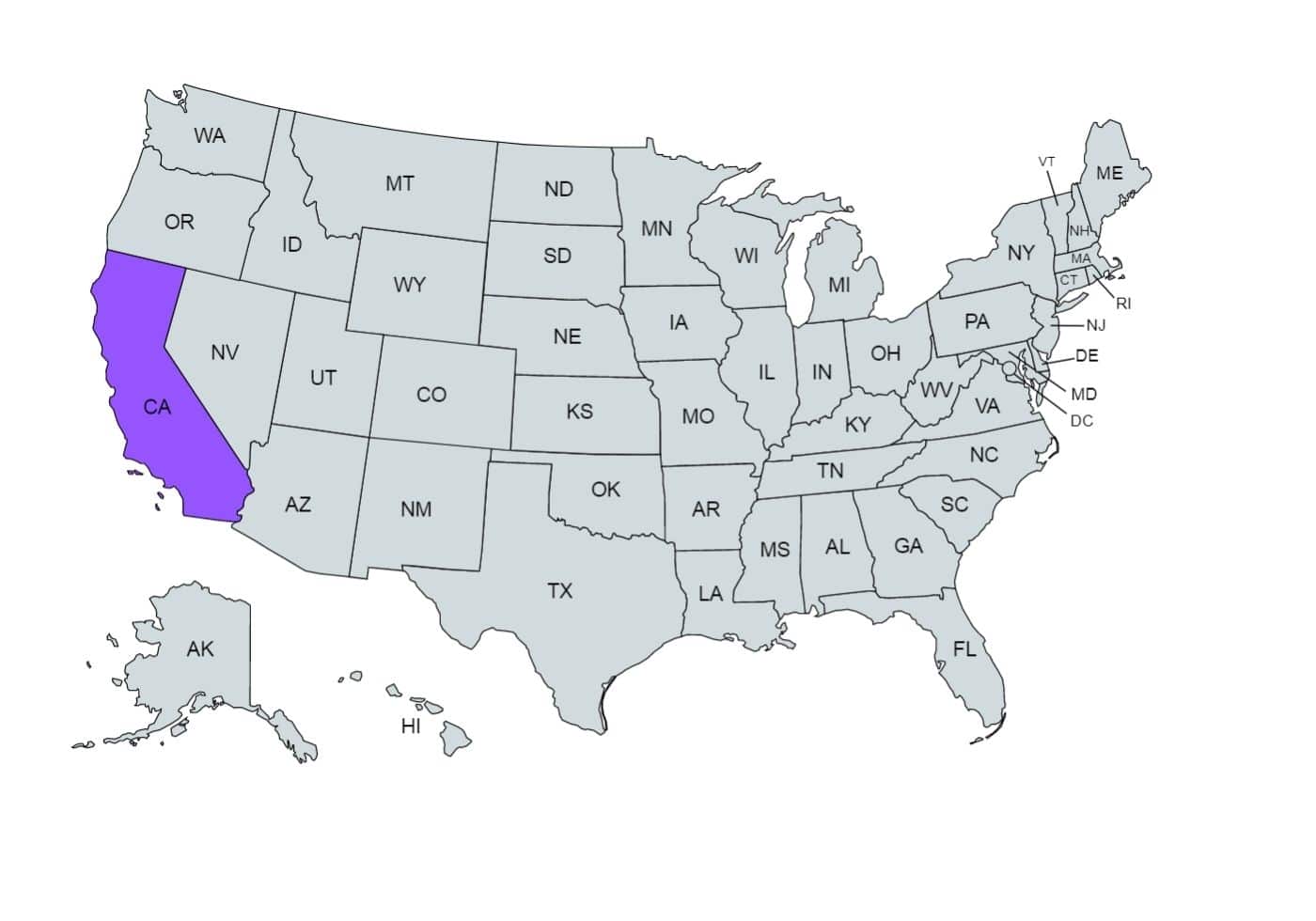

Managing personal finances effectively requires a clear understanding of your paycheck. For residents of California, a paycheck calculator is an invaluable tool that helps decipher the complexities of salary calculations, taxes, and deductions.

This article delves into what a California paycheck calculator is, how it works, and the benefits it offers to employees and employers alike.

What Is a California Paycheck Calculator?

These calculators are particularly useful for employees to understand their paychecks and for employers to ensure accurate payroll processing.

How Does a California Paycheck Calculator Work?

To use a California paycheck calculator, you typically need to provide several key pieces of information:

- Gross salary: Your total earnings before any deductions.

- Pay frequency: How often you receive your paycheck (weekly, bi-weekly, monthly).

- Federal filing status: Your tax filing status (single, married, head of household).

- State and local taxes: California state tax rates and any applicable local taxes.

- Deductions: Pre-tax and post-tax deductions, such as health insurance premiums, retirement contributions, and other benefits.

Calculation Process

Once the necessary information is inputted, the calculator processes the following:

- Federal income tax: Based on federal tax brackets and filing status.

- State income tax: Calculated according to California’s state tax rates.

- Social Security and Medicare: Standard deductions based on federal guidelines.

- Additional withholdings: Any extra amounts specified by the user for tax withholdings or deductions.

The calculator then subtracts these taxes and deductions from the gross salary to determine the net pay, providing an estimate of the take-home amount.

Benefits of Using a California Paycheck Calculator

Financial Planning

A paycheck calculator aids in effective financial planning by giving you a clear understanding of your net income. Knowing your take-home pay helps you budget more accurately, plan for expenses, and save for future goals. It also assists in making informed decisions about spending and investments.

Tax Preparation

Understanding how much tax is being withheld from your paycheck is crucial for tax preparation. A paycheck calculator breaks down federal and state taxes, helping you ensure the correct amount is being withheld. This can prevent surprises during tax season, such as owing additional taxes or receiving a smaller-than-expected refund.

Salary negotiations

For job seekers and employees considering a raise, a paycheck calculator can be a powerful tool in salary negotiations. By inputting different salary scenarios, you can see how changes in gross pay impact your net pay. A salary calculator California helps in negotiating a salary that fits your financial needs and expectations

Employer benefits

Employers also benefit from using paycheck calculators to ensure accurate payroll processing. Calculators help in determining the correct withholding amounts for taxes and benefits, reducing errors and ensuring compliance with federal and state regulations. This accuracy helps maintain employee satisfaction and trust in the payroll process.

Specific Considerations for California

State tax rates

California has a progressive state income tax system, with rates ranging from 1% to 13.3%, depending on income levels. The paycheck calculator accounts for these varying rates to provide an accurate estimate of state tax withholdings.

Local Taxes and Deductions

In addition to state taxes, some cities and counties in California may impose local taxes. A comprehensive paycheck calculator will include these local taxes to ensure a precise net pay calculation.

It also considers specific state deductions and credits, such as disability insurance (SDI) and paid family leave (PFL).

Cost of Living Adjustments

Given California’s high cost of living, understanding your net pay is crucial for budgeting effectively. A paycheck calculator helps you gauge how much of your salary will be available for housing, utilities, transportation, and other essential expenses, allowing for better financial planning.

Choosing the Right Paycheck Calculator

Accuracy and Updates

Select a paycheck calculator that is regularly updated to reflect current tax laws and rates. This ensures the calculations are accurate and reliable, providing a true picture of your take-home pay.

User-Friendly Interface

A good paycheck calculator should have a user-friendly interface, making it easy to input information and understand the results. Look for calculators that offer detailed breakdowns of taxes and deductions for better clarity.

Comprehensive Features

Choose a paycheck calculator that offers comprehensive features, including options for different pay frequencies, additional withholdings, and various types of deductions. This flexibility allows you to tailor the calculations to your specific situation.

To Wrap Up

A California paycheck calculator is an essential tool for both employees and employers, offering clarity and precision in understanding take-home pay. It aids in financial planning, tax preparation, salary negotiations, and accurate payroll processing.

By choosing a reliable and comprehensive paycheck calculator, you can ensure that you are well-informed and financially prepared, no matter your income level or job role. Understanding how these calculators work enhances your financial literacy and empowers you to make informed decisions about your finances.