Navigate the turbulent seas of the stock market with precision! “Investment Analysis: The Role of Technical Indicators” unveils the secrets of mastering market movements. Discover how these powerful tools can forecast financial futures and enhance your trading strategy. Are you ready to decode market trends with us? Let’s dive in! Accessing expert insights on technical indicators is made possible through the connections provided by Bitcoin Revolution.

Developing a Trading Strategy Using Technical Indicators

The first step in crafting such a strategy involves selecting the right indicators that align with your trading style and objectives. For instance, a day trader might prioritize short-term indicators like the Stochastic Oscillator or RSI, while a long-term investor may lean towards moving averages and MACD.

Once the indicators are selected, the next step is to define the specific parameters and thresholds for each indicator.

This includes setting the periods for moving averages or the overbought and oversold levels for the RSI. Customizing these parameters is crucial as it tailors the indicators to better fit the market conditions and the asset being traded.

The integration of these indicators into a cohesive strategy involves backtesting with historical data. This process helps traders understand how their strategy would have performed in the past, providing insights into potential profitability and risk. It’s essential to adjust the strategy based on backtesting results, refining the parameters or even discarding underperforming indicators.

Real-life application is the final and most critical step. Begin trading with a small amount of capital or use a demo account to see how the strategy performs in real-time market conditions.

This phase is vital for further tweaks and learning, as theoretical efficiency often differs significantly from real-world performance due to market volatility and psychological factors.

By following these steps—selecting appropriate indicators, setting customized parameters, backtesting, and real-life application—traders can develop robust trading strategies that enhance their decision-making process and potentially increase their market returns.

Combining Technical with Fundamental Analysis

While technical analysis focuses on price movements and trends, fundamental analysis evaluates a company’s intrinsic value through its financial statements, market position, and economic factors.

The synergy of these two methods allows investors to identify not only when to buy or sell but also why. For instance, fundamental analysis could signal that a company is undervalued based on its earnings growth and solid financial health.

Technical analysis can then be used to determine the optimal timing for entry or exit based on price trends and volume patterns.

To effectively combine these analyses, start by conducting a fundamental review of a company to assess its long-term viability and growth prospects. Look at metrics like P/E ratio, debt-to-equity ratio, profit margins, and revenue growth.

Once a fundamentally strong company is identified, apply technical indicators to find the best transaction points. For example, moving averages can help confirm the trend’s direction, while RSI can indicate if the stock is overbought or oversold within that trend.

Regular updating of both analysis types is crucial as market conditions and company fundamentals can change. Integrating news updates, earnings reports, and economic indicators into the analysis helps maintain the relevance and accuracy of your investment strategy.

This dual approach minimizes risks associated with relying solely on one method. It enhances the probability of successful investments by ensuring that purchases are not only made at technically sound times but also in fundamentally strong companies.

Technical Indicators and Risk Management

For effective risk management, one of the most useful technical tools is the volatility indicator, such as the Average True Range (ATR). The ATR helps in setting stop-loss orders that are adaptive to the market’s volatility.

For instance, in a highly volatile market, a wider stop-loss might be necessary to avoid getting stopped out prematurely. Conversely, in a stable market, tighter stops can be used to protect profits without risking large drops.

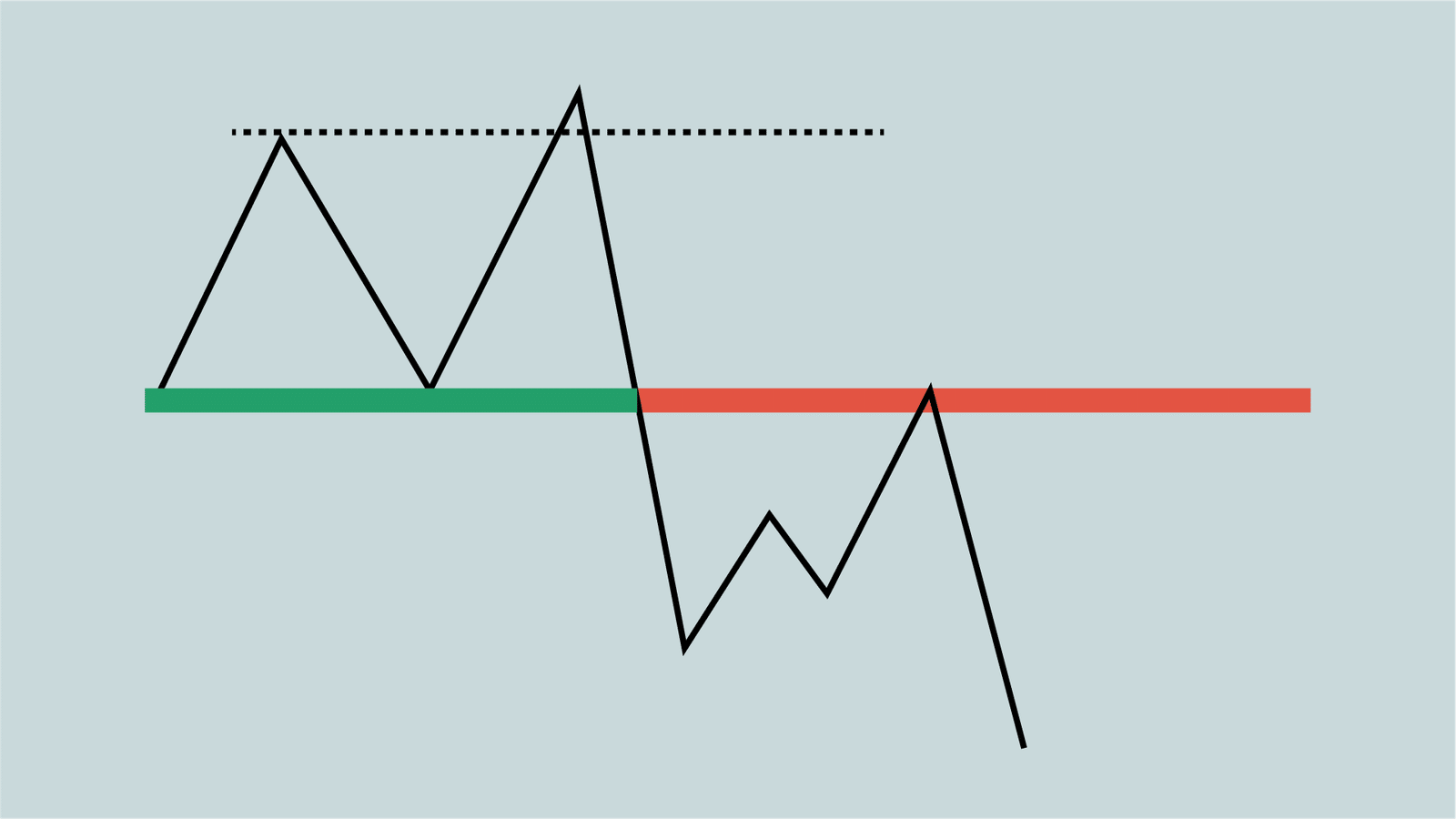

Another key strategy is the use of trend-following indicators like moving averages to avoid “catching a falling knife,” which refers to buying a stock in a downtrend hoping for a reversal. Instead, trend indicators can signal when a market begins to stabilize or rebound, enabling safer entry points.

Diversification of indicators is equally important. Relying on a single indicator can lead to biased or incomplete risk assessments. Thus, combining different types of indicators—momentum, trend, volume, and volatility—provides a more holistic view of market conditions. For example, while a moving average might suggest a bullish trend, confirming this with volume indicators and momentum can increase confidence in the trend’s strength and sustainability.

Conclusion

As our exploration of technical indicators concludes, remember that these tools are your compass in the vast ocean of market opportunities. Harnessing their power can dramatically transform your trading approach, offering clearer paths through the complexities of market behaviors. Stay curious, stay analytical, and let your investments flourish under the guidance of informed strategies!