Venmo: Linking Social and Financial Mindsets

Venmo enables money transfers between friends and acquaintances with ease. What about Venmo fees? There are no fees within the system, which has solidified Venmo’s position in the digital financial ecosystem. Nonetheless, the broader effects on our financial behaviors and societal interactions are often overlooked.

A bit of backstory: Venmo, a payment service, was born out of frustration. Friends and students Andrew Cortina and Ikram Magdon-Ismail were tired of the hassle of cash and checks. They envisioned a solution as simple as sending a text message, using SMS technology.

Their idea evolved into an instant money transfer app, which quickly attracted $1.2 million in investment. After changing hands twice, Venmo is now a subsidiary of PayPal, valued at $800 million.

Venmo Services & Fees Overview

| Function | Social Aspect | Venmo Fees |

|---|---|---|

| Splitting accounts | Split the bill with friends or colleagues | Free for individuals |

| Leaving comments and likes | Commenting and liking community transactions | Free for individuals |

| Privacy | Managing transaction visibility | Free for individuals |

| Messages with emojis | Adding emoji to messages when sending money | Free for individuals |

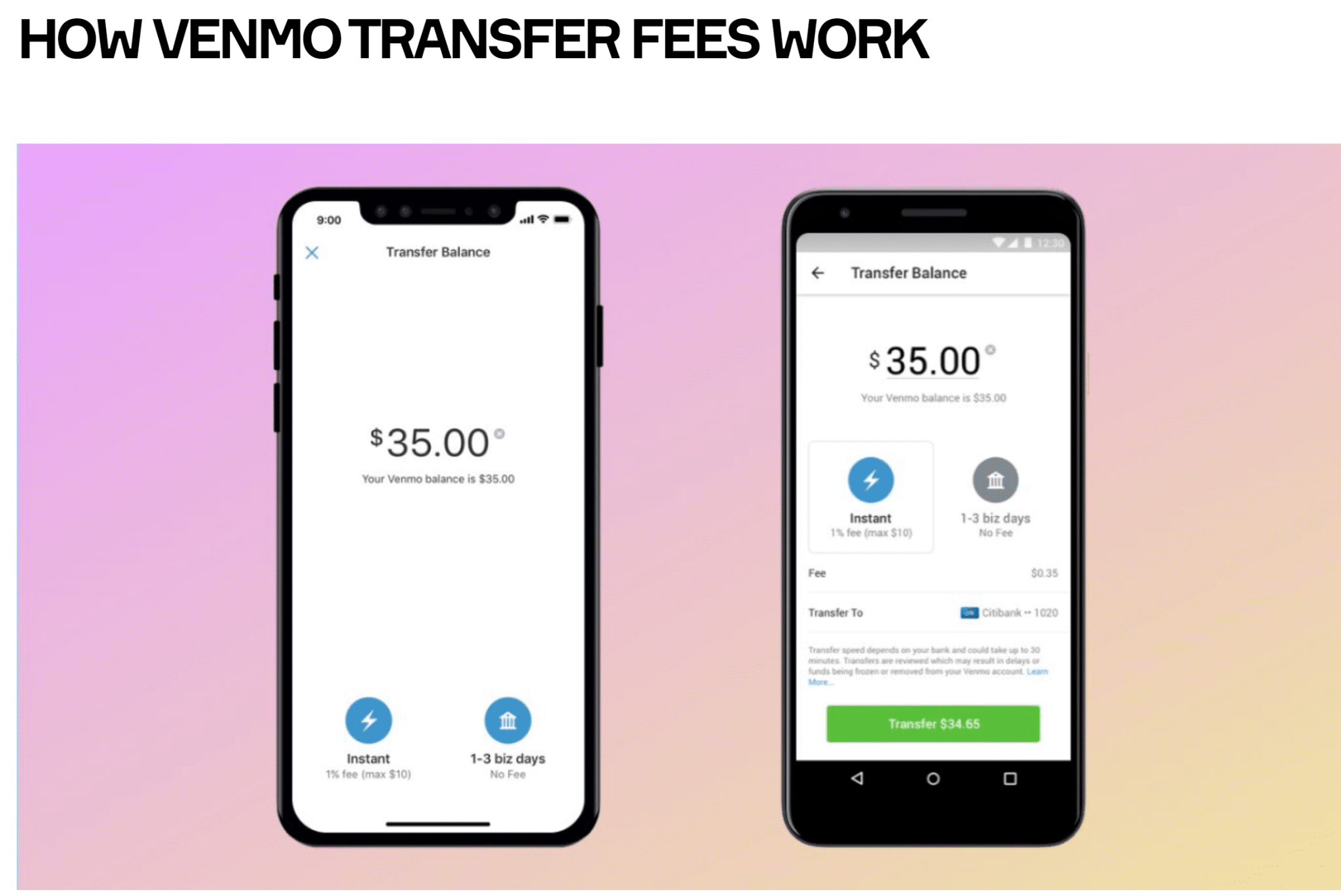

| Transfer money to a bank account | Transfer to a bank account or debit card | Fees for instant transactions min is $0.25, and max is $25 |

Social Aspects of Venmo

Venmo redefines the concept of money — it’s not just a medium of exchange, but also a tool for social integration and influence. By facilitating financial transactions within its system, Venmo provides a social experience for its users: they can comment on and “like” their friends’ transactions, fostering a sense of community and mutual support.

This changes the perception of money, transforming it into a means of expressing care, supporting a friend in times of need, or contributing to social initiatives.

Venmo turns financial interactions into a deeper and more meaningful process, where each transaction can tell a story or support a common cause. With experts from Rates, let’s take a closer look at how Venmo builds a virtual community of users:

- Virtual money, real connections: Venmo turns money into a social tool. Users can see their friends’ transactions, comment on them and even give likes. This creates a sense of community and social connection around finances.

- Financial transparency: Venmo gives us a peek into each other’s financial lives. We can find out what our friends spend money on, what hobbies they maintain, where they dine out. It may inspire us or make us envious, but either way it changes the way we think about money.

- Social norms and pressure: Venmo encourages competition and social influence. Being able to see how friends spend money can influence our own decisions. We may emulate or, conversely, avoid certain spending habits.

- Social support: Venmo becomes not only a tool for money exchange, but also a platform for communication and social interactions. We can support each other by sending money for a coffee or a donation.

So, Venmo is not just a money transfer app, but a platform where financial transactions are accompanied by communication with other users. Realizing the importance of the social aspect of money, we should make meaningful use of such services to maintain harmony between personal finances and social connections. This will help us to become more responsible and socially active citizens.

Business Aspects of Venmo

Venmo, as a next-generation payment system, is having a significant trust-based impact on financial relationships between consumers and businesses by offering elements of transparency and social engagement.

It is transforming traditional methods of interaction by making public transactions not only a means of exchanging money, but also a tool for marketing and promoting third-party companies.

By observing the financial transactions of competitors, it is possible to open new directions for the development of one’s own business. The publicity of transactions promotes transparency and trust, and encourages competition, which in turn leads to better goods and services on the consumer side.

How Venmo works with businesses: Three key points

- Business Profiles: Create a business profile linked to your existing account. This allows you to easily switch between your personal and business profile. Keep a record of all payments, tips, and other transactions in one place.

- Accept Payments: Venmo allows you to accept payments through the mobile app. You can accept contact payments, including cards and digital wallets, using the Tap to Pay feature. You can also print your QR code and place it at the register for convenient payment acceptance.

- Professional Look: Add photos to make your profile look professional. Your business will be visible in the feed of users who share your purchases. The system keeps transactions secure with data encryption and fraud monitoring.

By seeing how and what others are spending money on, consumers can make more informed choices and businesses can optimize their strategies and offerings. Venmo also serves as a platform for brands to demonstrate their social value, allowing entrepreneurs to build their reputation & attract new audiences.

Thus, besides facilitating financial transactions, Venmo plays a key role in shaping modern business models and consumer behavior, as well as trusting relationships between companies and their customers.

Venmo Business Account Payment Fees

| Payment type | Commission rate |

|---|---|

| Direct payments from another Venmo account | 1.9% + $0.10 |

| Contactless payments (Tap to Pay) | 2.29% + $0.10 |

| Payments using promotional codes | 1.9% + $0.10 + 2.9% for promotional codes |

Note: In a business account, Venmo charges a fee for each transaction received. These fees are automatically deducted from the total payment amount sent by the customer.

The revenues allow Venmo to maintain and grow the service. More about the pros and cons of choosing Venmo as a payment app is written by Irina Tsymbaliuk on Rates.

Summary

The nominalist theory of money (Definition) posits that the purchasing power of money isn’t determined by its material value, but by the credibility of the denomination set by the government. Venmo takes this concept further. This platform empowers each participant to trust others with a sensitive aspect of their financial activity. Here, financial transactions become a part of social communication.

Seeing friends’ transactions on Venmo doesn’t infringe on privacy. Instead, it creates a trusting environment where finances aren’t taboo, but a catalyst for connection and support. Observing others’ socially responsible financial behavior can guide users to make more informed decisions. Thus, Venmo nurtures a community where finance isn’t just a medium of exchange. It’s a tool for enhancing human capital, fostering trust, and strengthening social bonds.