In today’s age, safeguarding sensitive data is crucial for all businesses, especially in the context of mergers and acquisitions (M&A). During M&A transactions, companies often need to share information with partners or buyers.

Businesses must implement appropriate security measures to protect this data and ensure privacy and security. This article will discuss strategies for securing data in M&A deals to minimise the risk of unauthorised access or data breaches.

Recognising the Risks

Before delving into the strategies for securing information during mergers, acquisitions and divestures, it is important to understand the risks involved in handling sensitive data during M&A transactions.

Sharing sensitive information exposes both parties to threats from individuals seeking to compromise the integrity of the deal or exploit financial information. Additionally, any oversight in safeguarding data can lead to legal repercussions and significantly harm a company’s reputation.

Establishing Confidentiality Agreements

Confidentiality agreements play a major role in ensuring clear communication between businesses engaged in M&A transactions. These agreements establish guidelines on how information should be handled and protected throughout the transaction process.

When creating confidentiality agreements, companies must accurately define what qualifies as confidential information. This should encompass all details, such as business records, customer databases, intellectual property rights, existing contracts and proprietary information.

When it comes to outlining confidentiality responsibilities, it’s important to be clear about what can and cannot be shared in agreements.

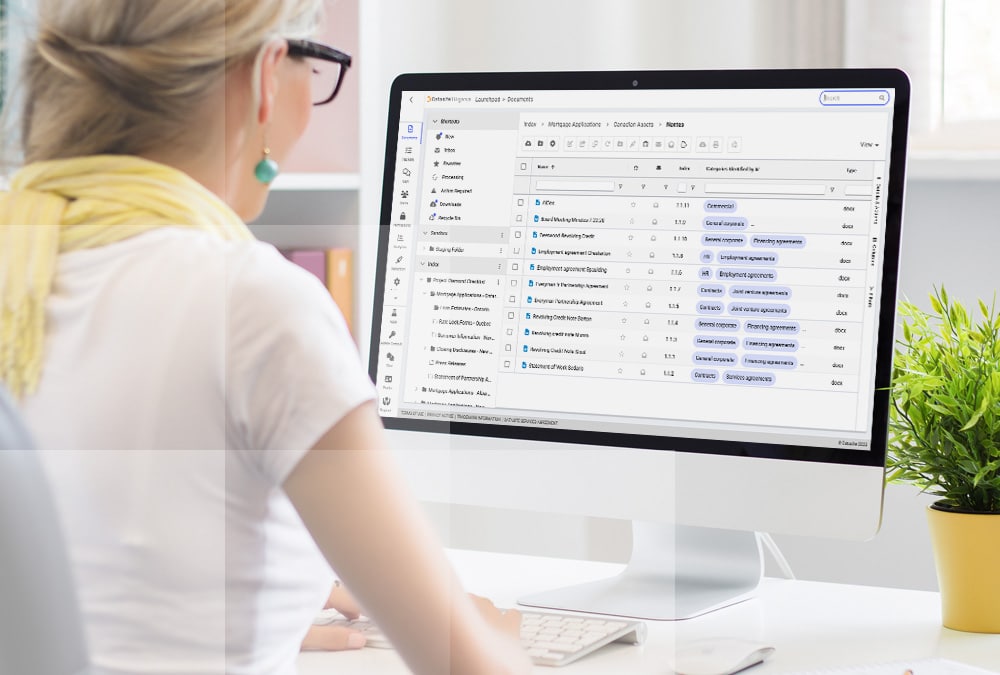

Setting Up Secure Data Rooms

Secure data rooms offer a controlled space for exchanging sensitive documents during M&A deals. These online platforms use encryption techniques and secure logins to keep information safe from unauthorised access.

For added security:

- Use multi-factor authentication: This extra layer of security requires users to provide multiple pieces of proof before accessing documents.

- Control access levels: Give permissions based on the specific roles of individuals in the deal hierarchy.

- Keep an eye on document activity logs: Review the activity logs from time to time to spot any suspicious behaviour.

Educating and Training Employees

Employees are key in protecting data during M&A transactions. Businesses should offer training on data protection practices to all involved employees.

The training should cover:

- Spotting phishing attempts: Teach employees how to recognise and avoid email scams that try to get information.

- Reporting incidents: Make sure employees know how to report breaches through the right channels.

- Ensuring data security: Teach employees about the procedures for moving, storing, and getting rid of data securely.

Assessing Vulnerabilities and Testing Security Measures

Another key element in safeguarding data during mergers and acquisitions is carrying out vulnerability assessments and security testing. These practices help pinpoint weaknesses or gaps in IT systems that could be exploited by unscrupulous individuals.

Collaborating with a cybersecurity company can be highly beneficial:

- Vulnerability assessments: An external cybersecurity firm can perform an evaluation of an organisation’s networks, identifying vulnerabilities that may jeopardise information.

- Security testing: By mimicking real-world cyberattacks, businesses can evaluate the effectiveness of their security protocols while uncovering any vulnerabilities that need to be addressed.

Proper Data Disposal Procedures

Upon completion of a merger or acquisition deal, both the buyer and seller must ensure that proper data disposal procedures are followed. This includes deleting or permanently eliminating any outdated copies of sensitive data.

Here are some suggested practices:

- Implement a deletion policy: Establish guidelines for removing documents to ensure they are completely erased from storage devices without leaving any traces.

- Use certified disposal methods: Work with accredited third-party vendors who specialise in document shredding or electronic file destruction.

- Keeping track of documentation: It’s important to maintain records of the information that was disposed of along with the paperwork for legal purposes.

Conclusion

For any company involved in M&A deals, safeguarding data should be a priority in their privacy strategy. By following practices like using confidentiality agreements and secure data rooms, providing employee training, conducting vulnerability assessments, and adhering to secure data destruction procedures, businesses can significantly lower the risks linked to data breaches or unauthorised access.

Protecting information not only upholds a company’s integrity and reputation but also ensures compliance with the relevant privacy laws.